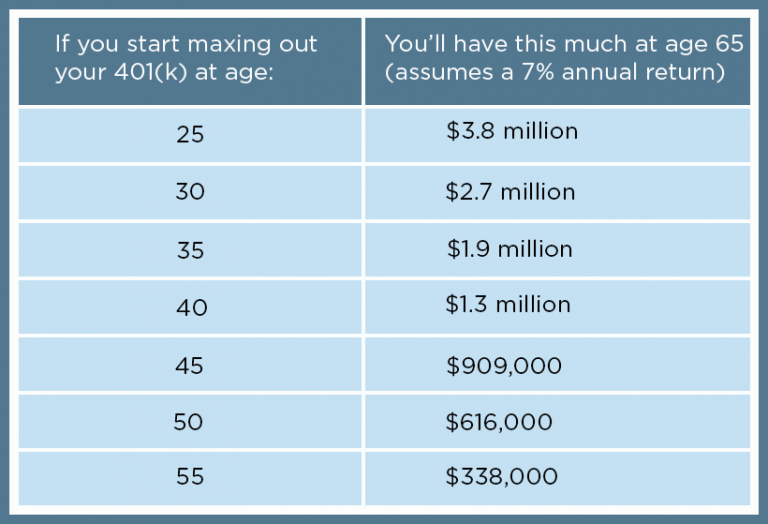

The real problem is a lack of employee participation. Continuing to max out your 401k at this level is an ideal strategy, Tips for Contributing to Your 401(k) Participateįor most workers, the flat or level 401(k) contribution limits over the past three years isn’t the real problem. If you divide that amount into monthly contributions, you’re making only slightly smaller payments which will benefit you in the long run. With the ability to increase your contributions by $500 in 2023, you may be wondering if you should. Congress prefers to increase contributions in increments of at least $500, which they did this year. Sometimes changes in the Consumer Price Index (CPI) have been very small, like on the order of 2% per year. The IRS determines whether or not to increase its contribution limits based on an annual basis. How Much You Should Contribute with the New Contribution Limits It is always a good idea to figure out whether a Roth 401k vs Roth IRA is best for you. Your employer can contribute a matching contribution that exceeds the $22,500 regular contribution limit, or even the combined $30,000 limit if you are age 50 or older. In addition, any employer matching contributions to the plans are not included in the employee contribution limits listed above. Not coincidentally, the 401(k) limits are virtually the same as the limits for both the 403(b) plan and the Thrift Savings Plan (TSP). More likely, you will want to contribute to both, in which case you’ll have to allocate how much of the $22,500 limit will go into each part of your 401(k). That means you can contribute up to $22,500 per year to either a regular 401(k) plan, or a Roth 401(k) plan. The Contribution Limits Also Apply to Roth 401(k) ContributionsĬontribution limits for Roth 401(k) contributions are the same as they are for traditional 401(k) contributions.

#Max 401k contribution 2021 over 50 plus#

That is the maximum allocation of $66,000, plus the $7,500 catch-up contribution. For example, for 2023, the maximum allocation is $73,500. That’s an increase of $9,000 over 10 years, which works out to be over 2% per year.

#Max 401k contribution 2021 over 50 full#

Even more obvious is the lack of increase in the catch-up contribution for a full six years, when the amount remained at $5,500 from 2009 through 2014.įrom 2009 through 2023, the maximum increased from $49,000 to $66,000. There has been only a $3,000 increase in the maximum contribution since 2009, and an even smaller increase in the catch-up contribution over the same space of time.Īnd as you can also see, contribution limits have stagnated in the past, such as 2009 through 2011, when they remain at $16,500 for three years in a row. The chart below shows the base 401(k) maximum contribution, the catch-up contribution for employees ages 50 and older, and the maximum allocation from all tax-sheltered retirement plans, from 2009 to 2023.Īs you can see, the rate of increase over the past eleven years has typically moved at a snail’s pace. Everything you need to know about 401k contribution limits for 2023:

At times, there have even been concerns that the contribution limits might be reduced, based on a negative inflation rate.įortunately, however, that scenario has never played out, and the limits have either been increased slightly or left flat. That means the total contribution for plan participants age 50 and older is $30,000.Įvery year, in October, the 401(k) contribution limits are reviewed.Ĭontribution limits increase more during years when the inflation rate is higher, and less when it is lower, as it has been in the past few years. Those represent the additional amount of contributions that you can make to a 401(k) plan if you are age 50 or older.įor 2023, that number will increase at $7,500. There will also be a change to the maximum allowed for catch-up contributions. This year the IRS announced there will be an increase to the maximum employee 401(k) contribution limit for 2023, increasing it to $22,500, a $2,000 increase from the 2022 tax season.

0 kommentar(er)

0 kommentar(er)